|

|

|

Mine your first gold in 5 steps

|

|

In this 25-step tutorial, we will guide you through the basics of CoinRepublik's town construction module. By the end of this tutorial, you will gain a solid understanding of all the processes involved in building a thriving town. We will cover essential activities such as mining gold, starting production processes, recruiting citizens, and other key steps necessary for town growth.

Our approach is straightforward, ensuring that even beginners can follow along without difficulty. Throughout the guide, you will find dozens of screenshots that provide a visual aid, making each step even clearer and easier to understand. We aim to simplify complex processes, so you can efficiently apply what you learn and see tangible progress in your town-building journey.

Whether you are new to CoinRepublik or simply looking to refresh your knowledge, this tutorial will provide a comprehensive overview of everything you need to build a successful town. From mining resources to managing production and citizens, you'll have the foundational skills to take on the challenges of growing your own community. Let’s dive in and start building!

|

|

|

Step 1 - build a gold mine

|

|

|

You just opened a new account and are ready to start building. Let's get down to business! One of the most important activities in CoinRepublik is gold mining. In CoinRepublik, 1 gram of gold represents 1 gram of real 24k gold. Gold is extracted from gold mines, and each mine can yield up to 0.05 grams of gold in a single mining process. To begin, go to the indicated patch below and click on it to start mining. This is the first step towards accumulating resources and building your town into a thriving community. Let the mining begin!

|

|

|

|

|

The following dialog will pop up. Choose 'Production' from the top menu, and then click on the gold mine. When you hover over the gold mine, a popup will appear showing which resources will be consumed during the process. If a resource is highlighted in green, it means you already have it. If you don’t have all the necessary resources, don't worry—we will cover how to buy or produce them later in this tutorial. This ensures that you understand how to gather everything you need before beginning production. Now, let's move forward with the next steps to set up your gold mine!

|

|

|

|

|

Now that the building process has started, it's time to consider the workforce needed for construction. Depending on the type of building, you will require workers. Your town initially has 14 citizens, many of whom are already employed in the initial buildings. However, you have 5 citizens available for construction tasks. Currently, one of these workers is assigned to build the gold mine, while the other 4 are available for other processes. Efficient use of your workforce is crucial for the growth of your town, so plan accordingly as we continue developing the different parts of your settlement.

|

|

|

|

|

Under normal circumstances, it takes 6 hours for the building process to complete. However, you can significantly speed up this process by hiring other players to help you. This cooperative approach allows you to finish construction faster and get your town up and running more efficiently. In the next section, we will teach you how to speed up any process, including production processes, by leveraging teamwork and resource management. Learning how to accelerate different activities will be a key advantage as you continue building and expanding your town. Stay tuned to discover all the tips and tricks for faster growth!

|

|

Step 2 - speed up a process

|

|

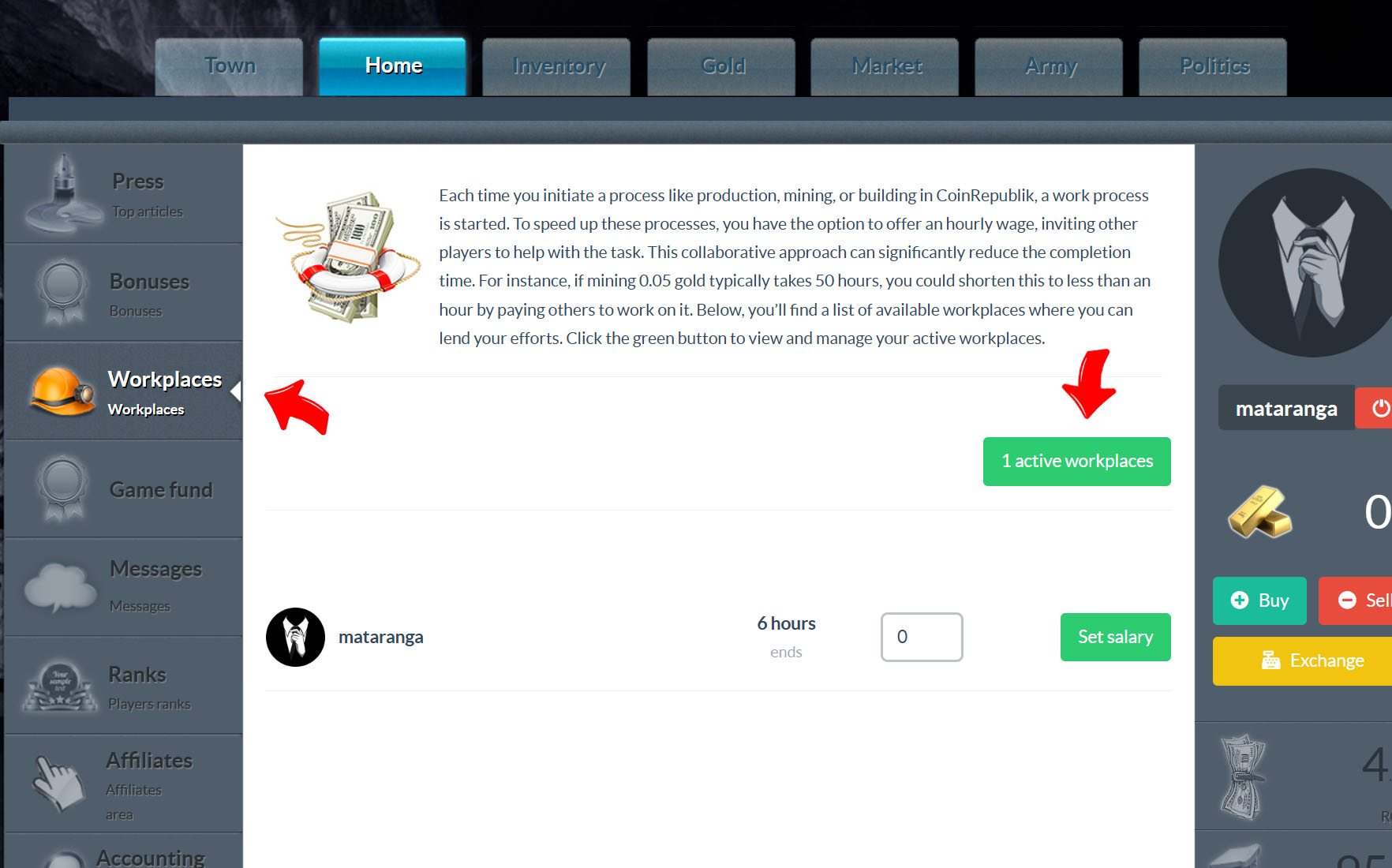

Every time you start a construction, renovation, or production process, a new workplace is automatically created. In our example, a workplace has been created that will be active for 6 hours. To view all your workplaces (also known as processes), navigate to Home > Workplaces. On that page, click on the green button, and a list of your active processes will appear.

Now, you can set a salary per hour for each workplace. Other players can join and work on your processes, and for every hour they work, the process time decreases by an hour. Essentially, if a player works for 6 hours on your gold mine, the building process can be completed instantly. Setting an attractive salary can greatly speed up the completion of your construction projects.

Keep in mind that salaries may vary depending on the country in which you are playing. The in-game currency mirrors real-world currency, so 1 virtual unit equals 1 unit of the real currency in that country. For example, in the United States or Spain, a reasonable salary might be between 0.01 and 0.05 per hour. In Hungary, a good salary would be 10-50 HUF per hour. The minimum salary you can set is 0.01.

Once you've set the salary, all you need to do is wait for workers to join your process. If no players show up to work, consider increasing the salary to make your workplace more attractive and move it higher on the list of available jobs. A competitive salary can help you find workers faster, allowing you to complete your projects more efficiently. Managing your workplaces and setting the right salary is key to advancing your town development and staying ahead in the game.

|

|

|

|

Step 3 - mine your first gold

|

|

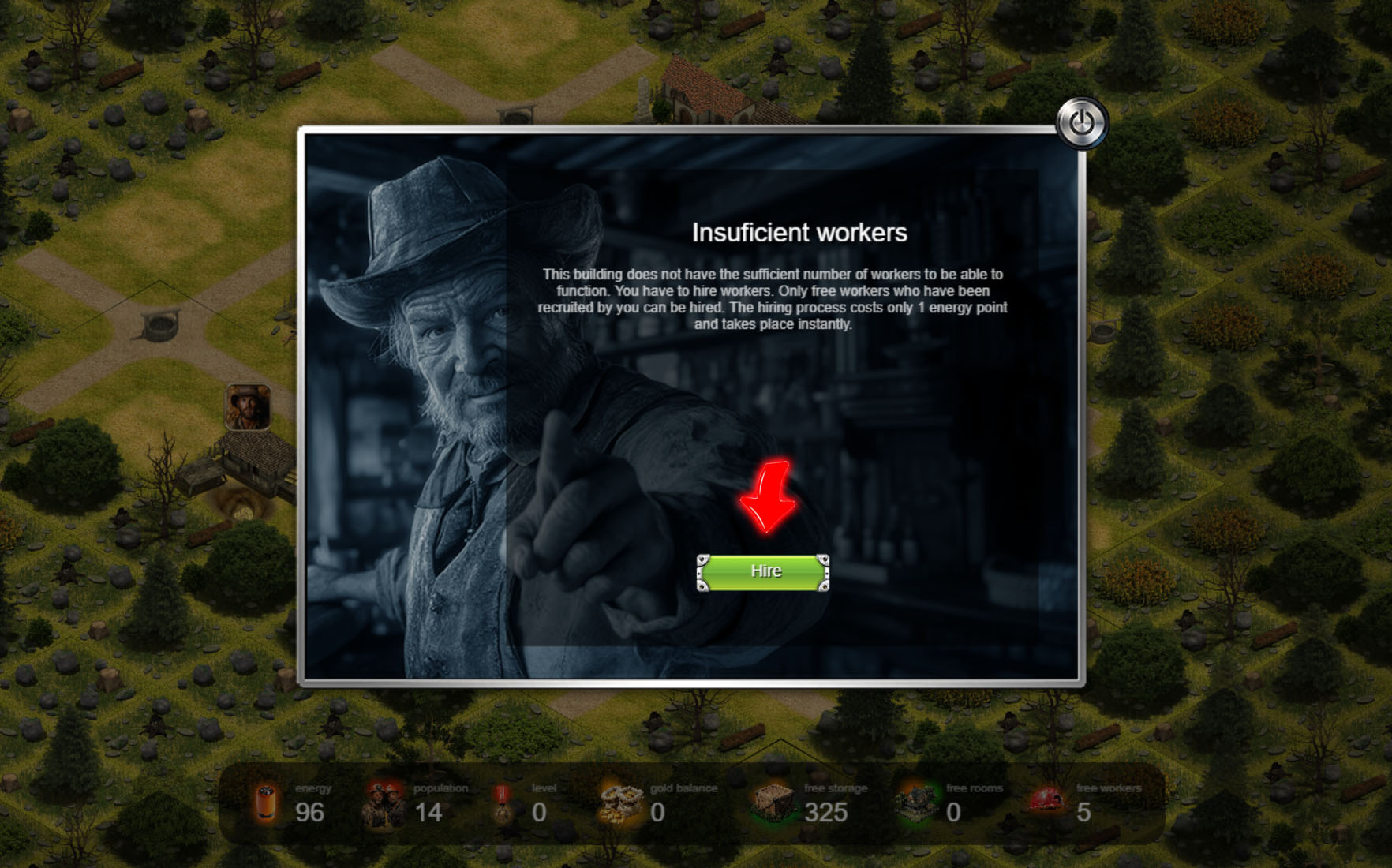

After 6 hours or more, the gold mine is ready, and we can start mining gold. However, just like in real life, things are a bit more complicated. As you can see below, if you click on your new gold mine, a message will appear indicating that the gold mine needs an employee in order to function. Each building requires workers to operate effectively. For instance, the gold mine needs regular workers, whereas other buildings, like a hospital, need qualified workers. Depending on the building level, you may need between 1 and 5 workers.

In this case, we need to hire a worker. To do this, click on the 'Hire Worker' button. After a short while, you may see a new message stating that there are no free workers available. This happens because the initially provided workers cannot be hired. While you do have some initial free workers, they are only available for construction or renovation processes and cannot be employed for building operations.

Since we need workers but don't have any available, there are two options: we can recruit a new worker using the town hall, or we can buy a worker from the market. Let's explore the second option.

To buy a worker from the market, navigate to the market section. Here, you will find a list of available workers offered by other players. Workers vary in price based on their skills and the demand in the marketplace. Choose a worker that fits your budget and needs. Once purchased, the worker will be added to your town, and you can assign them to the gold mine.

Hiring the right workforce is an essential part of ensuring your buildings operate efficiently, and as you advance, managing your labor force will be key to optimizing your town’s growth. With your new worker in place, the gold mine will be fully operational, and you can begin mining gold, taking yet another step toward growing your thriving town.

|

|

|

|

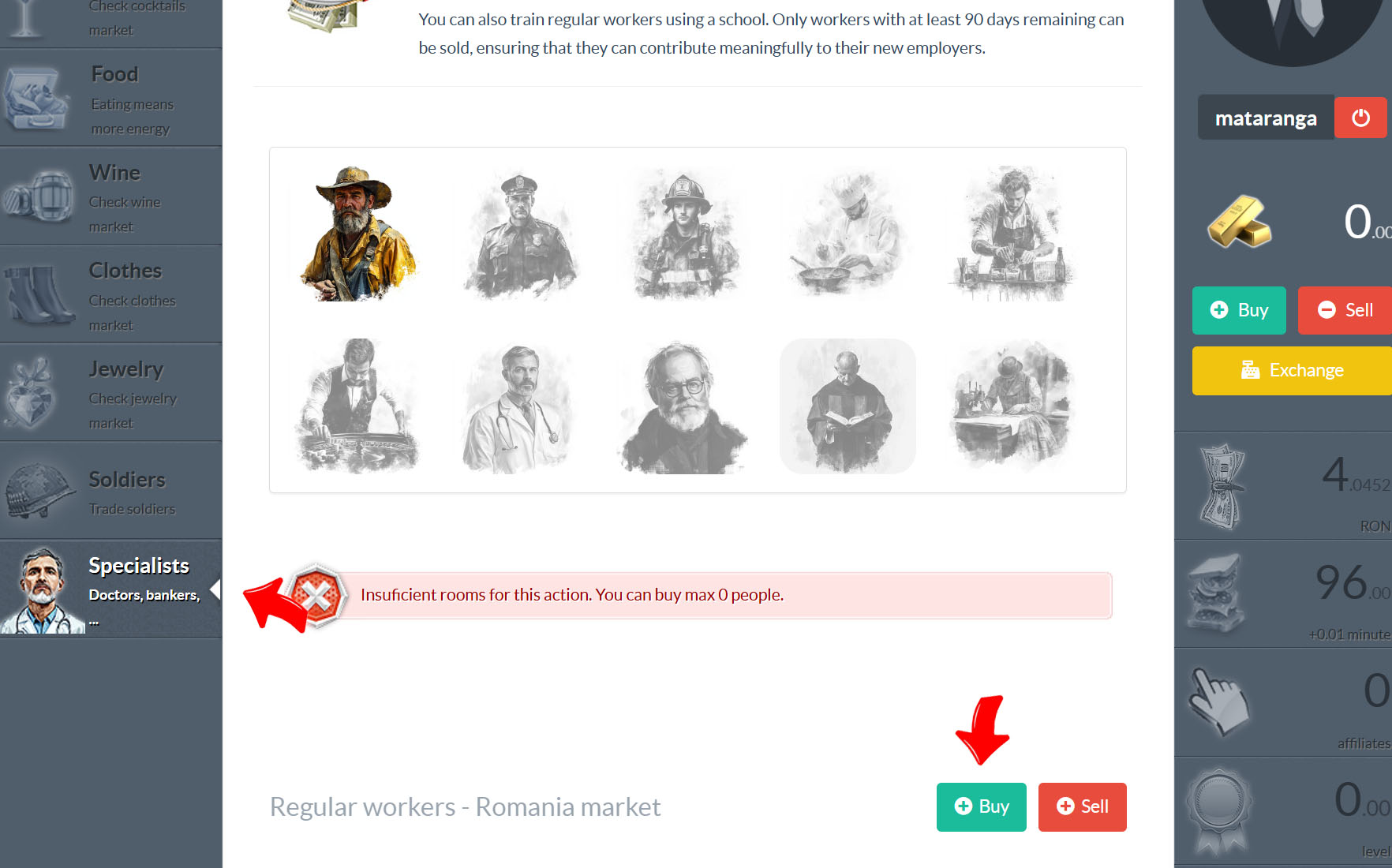

Navigate to Market > Specialists. Choose the regular workers market (it’s the default option) and click the 'Buy' button. A popup will appear where you need to specify the quantity. Enter '1' for the quantity and press 'Send'. However, a surprise awaits—a new error message pops up, indicating that there aren't enough free rooms for new workers. But what does this mean? Workers need a room where they can stay, and these rooms are provided by houses.

Initially, your town has 7 houses, and each house provides 2 rooms for workers, giving you a total of 14 rooms. However, you already have 14 workers, meaning that all available rooms are occupied, and your town is currently full. So, are we stuck? Fortunately, the answer is no, but, as I mentioned earlier, it won’t be that easy.

To accommodate more workers, we need to create more rooms for them. This means building additional houses to expand the capacity of our town. Houses are essential for providing the necessary living space for workers, and as your town grows, managing housing will be a crucial part of keeping your workforce happy and efficient.

|

|

|

|

Step 4 - build the first house

|

|

Go back to the map and click on the spot indicated in the image. It’s crucial to understand that where you build is often more important than anything else. The location you choose can have a significant impact on the efficiency and productivity of your town. For example, placing a gold mine near key resources or transport routes can greatly improve its performance. So, click on the indicated spot to proceed, keeping in mind that thoughtful planning of building locations will contribute to the success of your growing town. Let’s make the most strategic choice possible!

Hiring the right workforce is an essential part of ensuring your buildings operate efficiently, and as you advance, managing your labor force will be key to optimizing your town’s growth. With your new worker in place, the gold mine will be fully operational, and you can begin mining gold, taking yet another step toward growing your thriving town.

|

|

|

|

|

Now, click on the spot. The usual menu will appear. Navigate to 'Services' and select 'House' (the first option in the row). This will initiate a new construction process, which, as you already know, can be easily sped up by hiring additional help. Before proceeding, make sure you have all the necessary resources, such as clay and wood. Constructing a house requires one worker, and it also consumes energy, so managing your resources effectively is crucial. Building houses is an important part of expanding your town, providing more rooms for workers and supporting future growth. Let’s get started!

|

|

|

|

After 6 hours or less, we have a brand-new house and two extra rooms for workers. Great! Now we can finally bring new workers to the town. As you can see in the screenshot, the bottom bar clearly indicates that we have two free rooms available. Now, navigate to Market > Specialists > Regular Workers and click 'Buy'. Specify only one worker—it’s important, and I will explain why later. Once you click 'Buy,' you are ready to proceed. A new worker has entered the town, and this time, they can be hired for various tasks.

When you buy workers, specialists, or products, you are interacting with an automated market, and payments are made using the local currency. Fortunately, when you signed up, you received some free local currency, which will help you get started. You can find your currency balance on the right side of any page for easy reference.

Understanding how the automated market works is important, as it can also be a good source of profit. The automated market acts as both a buyer and a seller, meaning you can buy or sell items without waiting for other players to take action. Every time a transaction occurs, the market adjusts the price accordingly. This price fluctuation can create opportunities for smart players to profit by buying low and selling high.

However, for now, let’s focus on our primary task—bringing new workers into the town and getting our gold mine operational. With the new worker ready to be hired, we are one step closer to expanding our production capacity and growing the town. Remember that efficient use of your workforce is crucial to progress, and making smart choices in the automated market can enhance your financial standing in the game. Let's head back to the town and get started on the next task!

|

|

|

|

After 6 hours or less, we have a brand-new house and two extra rooms for workers. Great! Now we can finally bring new workers to the town. As you can see in the screenshot, the bottom bar clearly indicates that we have two free rooms available. Now, navigate to Market > Specialists > Regular Workers and click 'Buy'. Specify only one worker—it’s important, and I will explain why later. Once you click 'Buy,' you are ready to proceed. A new worker has entered the town, and this time, they can be hired for various tasks.

When you buy workers, specialists, or products, you are interacting with an automated market, and payments are made using the local currency. Fortunately, when you signed up, you received some free local currency, which will help you get started. You can find your currency balance on the right side of any page for easy reference.

Understanding how the automated market works is important, as it can also be a good source of profit. The automated market acts as both a buyer and a seller, meaning you can buy or sell items without waiting for other players to take action. Every time a transaction occurs, the market adjusts the price accordingly. This price fluctuation can create opportunities for smart players to profit by buying low and selling high.

However, for now, let’s focus on our primary task—bringing new workers into the town and getting our gold mine operational. With the new worker ready to be hired, we are one step closer to expanding our production capacity and growing the town. Remember that efficient use of your workforce is crucial to progress, and making smart choices in the automated market can enhance your financial standing in the game. Let's head back to the town and get started on the next task!

|

|

|

|

Step 5 - finally mining the first 0.01 gold

|

|

Now, click on the gold mine and then click the 'Hire Worker' button. After a brief wait of about 2 seconds, the building will be ready to start mining. Click on it again, and the following dialog will appear. Production buildings usually produce up to 10 different types of products. However, gold mines only produce gold. A level 2 mine can produce 0.02 grams in a single process.

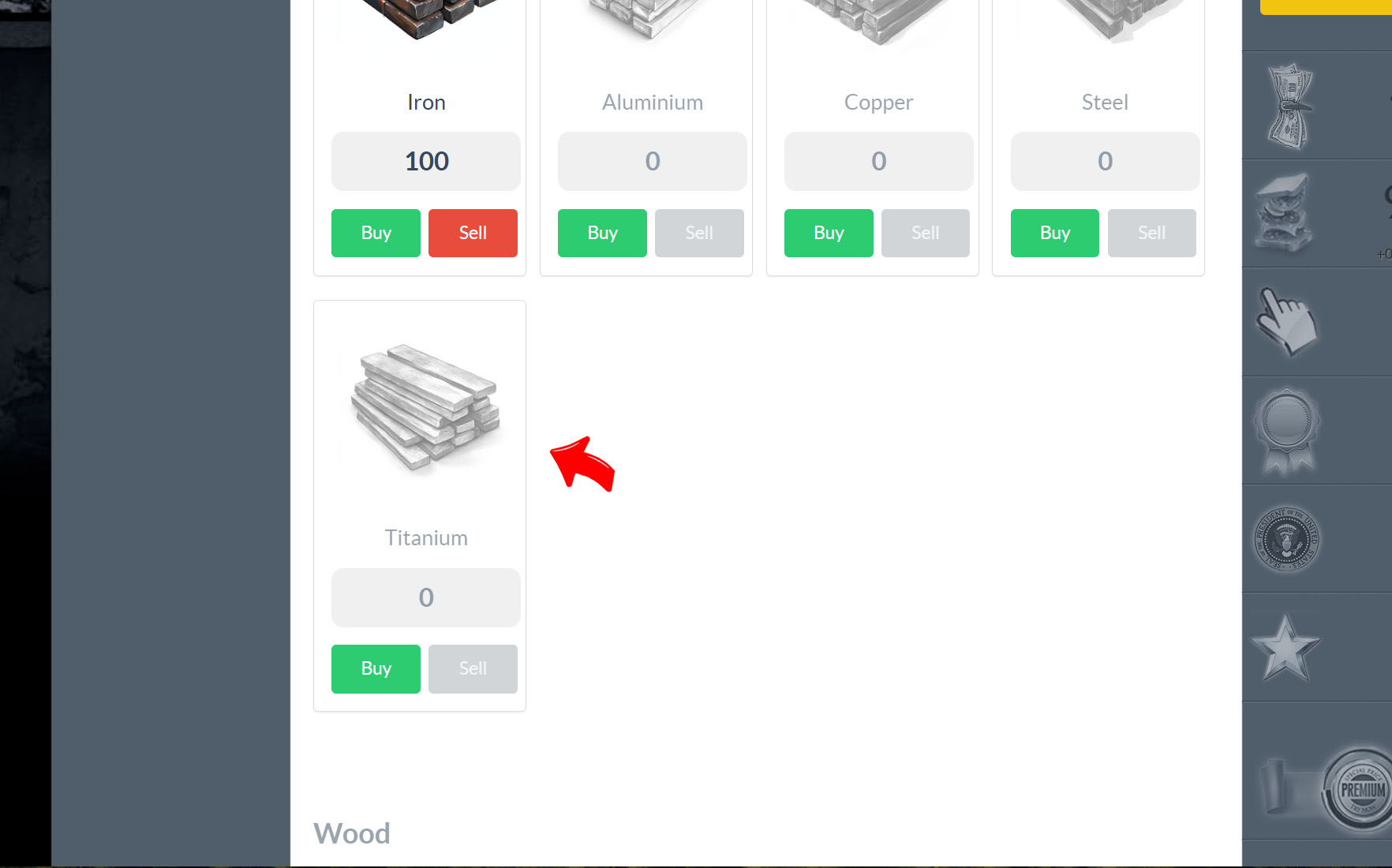

Now, hover over the gold button, and we have another surprise: there are some red lines. This indicates that we don’t have the necessary raw materials to produce the required amount of gold. To produce 0.01 grams of gold, we need titanium, oak wood, and gold ore. Unfortunately, we currently lack the capability to produce any of these raw materials ourselves.

Luckily, we have some local currency and access to numerous automated markets. Automated markets allow us to purchase resources instantly without waiting for other players, which makes acquiring the necessary raw materials much more convenient. With this in mind, it’s time to go shopping to gather everything we need.

Head over to the market, and use the local currency to purchase the titanium, oak wood, and gold ore. Once we have all the required materials, we can finally begin the gold production process and move forward with our town's growth.

|

|

|

|

|

Now, go to Market > Raw Materials and find the Titanium panel. Click on 'Buy' to access the automated market where you can purchase Titanium. Buy 25 units of Titanium, and then do the same for oak wood and gold ore. By buying these raw materials, you ensure that all necessary resources are available for production. Once you have acquired 25 units of each—Titanium, oak wood, and gold ore—you will have everything needed to start the production process. With all resources in place, you are now ready to initiate gold production and continue expanding your thriving town.

|

|

|

|

Go back to the town, click on the gold mine, and then click on the '0.01 grams' button. The production process will begin, and the necessary resources will be consumed. In approximately 10 hours or less, you will be able to collect your first 0.01 grams of gold. While we wait, let’s discuss the raw materials required for gold mining.

Unlike most other products in the game, gold does not have a fixed price. Initially, mining 1 gram of gold requires 1000 units each of oak wood, gold ore, and titanium, plus 1000 energy and 1000 hours of labor. Mining 0.01 grams of gold means consuming 1% of these resources, which makes the process more manageable but still resource-intensive.

There is a concept called the “target mining quantity per day,” which is initially set at 1 gram of gold per day. If more than 1 gram of gold is mined in the last 24 hours, the system automatically increases the mining costs by 10% per hour to maintain this target rate. As a result, mining costs will vary over time, depending on overall mining activity in the game. In theory, this should lead to a gradual increase in costs, especially as more players mine gold. However, the system also accounts for the influx of new players.

The mining limit increases by 0.01 grams per day for every 10 new active players in the game. For instance, if there are 1500 active players in a day, the daily mining target will increase to 1.5 grams of gold. This dynamic system keeps the game balanced by controlling gold production and ensuring that as more players join, the resource availability scales accordingly. Now that we understand how mining costs and production targets work, let’s keep pushing forward to grow our thriving town!

After about 10 hours, the mining process will conclude, and you will be ready to collect the gold. There is just one final step to complete. When the mining process ends, an icon will appear on the gold mine. Click on the gold mine patch, and the following dialog will be displayed. Click 'Collect,' and that’s it—you have successfully mined your first 0.01 grams of gold! You should now see a transaction recorded in your accounting section, and your balance will have been updated accordingly. Congratulations on reaching this milestone in your town's development!

|

|

|

|

|

|

Open Beta

Open Beta